Is anyone else feeling just a little cosmic irony right now? Because here we are, staring at a stock market that’s doing cartwheels instead of crying over spilled tariffs—remember those? When Trump first dropped the tariff bombshell, our retirement accounts were screaming louder than a Leo in a spotlight, and Wikipedia had already rushed to slap a 2025 Stock Market Crash page on the scene. Yet, here we are, with August just around the corner and tariff pauses supposedly ending, but the market barely batting an eye. Could it be that the stars (and the market) have decided Trump’s nickname—TACO (Trump Always Chickens Out)—is written in the financial heavens? The on-again-off-again trade drama seems to have zapped the usual panic into a meh… Who can blame the market? We all secretly think, why stress until absolutely unavoidable? Thank Neptune’s retrograde or Mercury’s shenanigans, but for now, at least, our wallets are smiling with a second month of gains. Is this cosmic calm before the storm, or just another astrological snark? Buckle up, darlings. LEARN MORE

The stock market being up is probably one of my favorite parts about this month’s report. Why? Because of the irony.

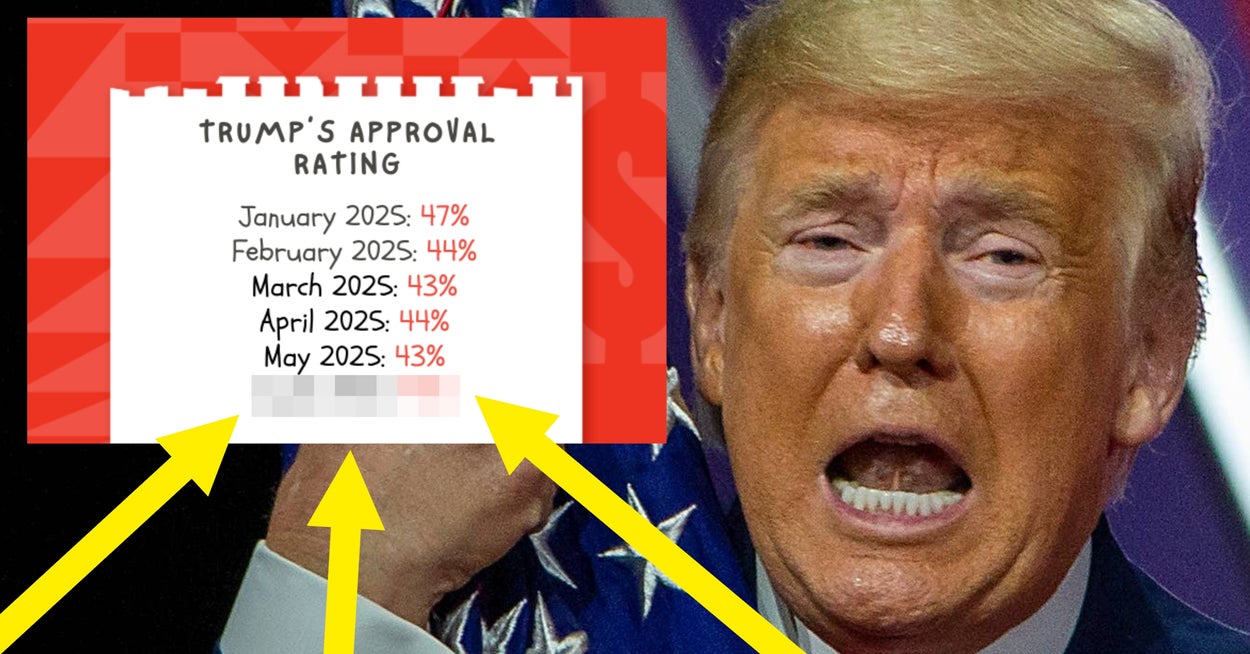

You see, it’s amazing that our retirement accounts aren’t screaming in as much pain as they were a few months ago when Trump first announced tariffs, and Wikipedia subsequently created a 2025 Stock Market Crash page. Which may make you consider: Hmmmmm, if pauses on tariffs are meant to end soon on Aug. 1, then why isn’t the stock market reacting in the same way?

One answer from economists? Because of Trump’s new nickname: TACO (aka, Trump Always Chickens Out). Meaning, Trump’s trade deals and tariff pauses have been an on-again-off-again affair that the market may have a hard time taking seriously now that it’s meant to be on-again. The attitude seems to be, Why worry until we have to?

That’s good for citizens, at least, who saw a second month of gains.

Auto Amazon Links: No products found.

This will close in 0 seconds

This will close in 0 seconds